Why gCC invested in YGG, or Yield Guild Games.

YGG Update

YGG recently announced a $1.3M seed round raised with gumi Cryptos Capital, Delphi Digital, Scalar Capital, BlockTower Capital, Ascensive Assets and Youbi Capital.

YGG generates NFT yield from “Play to Earn” games. It is an innovative Non-Fungible Token community platform and it represents the next investment of gCC into the NFT space after OpenSea, which recently announced a $23M investment round led by Andreesen Horowitz (a16z). Read more about why we invested in OpenSea here.

What is YGG?

YGG is a decentralised autonomous organisation (DAO) that collects “play-to-earn” rewards from games by incentivizing player/members to complete daily in game tasks and compete for in game resources. It leverages and monetizes in game assets that the DAO itself has acquired but also those that are on loan to the guild from asset owners who want to profit share with the guild. It aims to bring players together to earn in-game reward tokens that can eventually be converted to local fiat currencies.

Play to Earn Gaming

Here is a documentary of how Play to Earn has transformed lives in the Philippines during COVID.

Here is an episode of the MikoBits show where Miko interviews Gabby Dizon, co-founder of YGG:

Why did gCC invest in YGG: The People.

Above everything in this opportunity it is a team first opportunity. gCC partner Miko Matsumura has known Beryl Li and Gabby Dizon for many years through friends in the Philippine blockchain network and has been waiting for just such an opportunity to work with them. Gabby is the kingpin of Philippine gaming including being former president of the Game Developers Association of the Philippines.

Another super important part of our methodology is that we value time spent building a relationship with our entrepreneurs. Even if we don’t have a previous investment with them, if we have a relationship of some sort, built up over time, the longer we’ve had time to see how the entrepreneur behaves, how they execute, and how they think.

The more time we spent with Gabby and Beryl, the more positive we felt about them, their vision, and their ability to make it happen.

Blockchain Onramp

One of the majorly attractive elements of the YGG business model is how YGG has formed a repeatable and scalable onramp to blockchain and cryptographic assets for gamers. As we know, gamers often represent the earliest adopters of any new technology, and YGG has a tremendous ability to recruit and convert non-crypto gamers into becoming crypto gamers. This is through the powerful mechanism of “Play to Earn” gaming. So instead of driving an Uber or Grab Taxi, gamers mainly in the Philippines or Indonesia who never owned blockchain assets before are being introduced to the blockchain through blockchain games like Axie Infinity, Sandbox or the upcoming Illuvium (where YGG itself is an early investor).

Arbitrage in the Attention Economy

We see this primarily as an arbitrage opportunity in the attention economy.

This is certainly not the first such model. We see other business models in this lineage including IGN, the China based World of Warcraft in-game gold mining company, and Machine Zone. But unlike IGN and Machine zone which were headquartered overseas, the business model is not exploitative, but supportive of members.

Business Model and Defensive “Moat”

Obviously as a professional Venture Capital firm, we aren’t in the business of making charitable contributions. But it’s our foundational thesis that blockchain based assets are part of open source infrastructure. And open source is a competition for consent. So really, as soon as you make a system that rewards people properly, you can easily gain their trust, loyalty and participation. We believe YGG is just such a beneficiary of open source infrastructure, and that the network effect implicit in the governance token creates a very significant moat for copycats.

We have seen exponential growth from tokenized players in our portfolio such as Celsius and their CEL token and we see well designed token economics as being a significant way to enhance network effect. Celsius promises 80% of their profit to be distributed to their users. In this sense a more “charitable” model creates a stronger network effect. Celsius recently crossed 14B in Assets Under Management (AUM) as a testament to this hyperscaling model.

Moat: the Threat of Vampirism

Obviously the idea of a “vampiric” competitor such as what Sushiswap did to UNI is a way to counteract this network effect moat. The question becomes the specific dynamics associated with this market. For example in the Oracles market it is beneficial to have very large players like ChainLink because their sheer size enables more reliability and decentralization as well as staking power.

Moat: Collective Bargaining Power

While it’s certainly possible to launch other “guilds” the idea of there being a collective bargaining power in being the largest guild follows real world examples such as the United Auto Workers (UAW) or similar very large labor unions. We see the goal of adding 3M users to blockchain games as being a hypergrowth strategy that can create the power to even alter in-game rewards by directly negotiating with game developers.

Moat: Governance Token as Acquisition Capital

A discussion I had with the team was about how even though there is a dazzling constellation of tokens out there, that the process of growing large and listing with exchanges and achieving liquidity at scale becomes a barrier to smaller entrants. So as a “listing” asset the governance token has the ability to act as a form of acquisition capital to entice productive smaller guilds to join rather than beat YGG at their own game.

The Key Role of Delphi Digital

Gabby and Beryl selected a highly specialised group of early investors, including Delphi Digital, Scalar Capital, BlockTower Capital, Ascensive Assets, Youbi Capital, Free Company, and others. Animoca Brands is involved as well, so they’ve got a really neat group of people around them, all of whom offer a unique domain knowledge and value-add. They’ve assembled an all-star team in blockchain gaming and DeFi, not just random investors.

gCC became particularly interested when we spoke to Anil Lulla of Delphi Digital. We became aware that Delphi were more than just traditional investors in YGG but strategic investors because they own millions of dollars worth of Axies – the Pokémon-like fantasy creatures needed to play one of the NFT games that YGG supports Axie Infinity.

The Managing Directors of Delphi are too busy to play Axie all the time. As such, they are experiencing pain because they have a capital asset capable of producing DeFi yield, but it’s unproductive unless there are pilots.

Player Market Growth

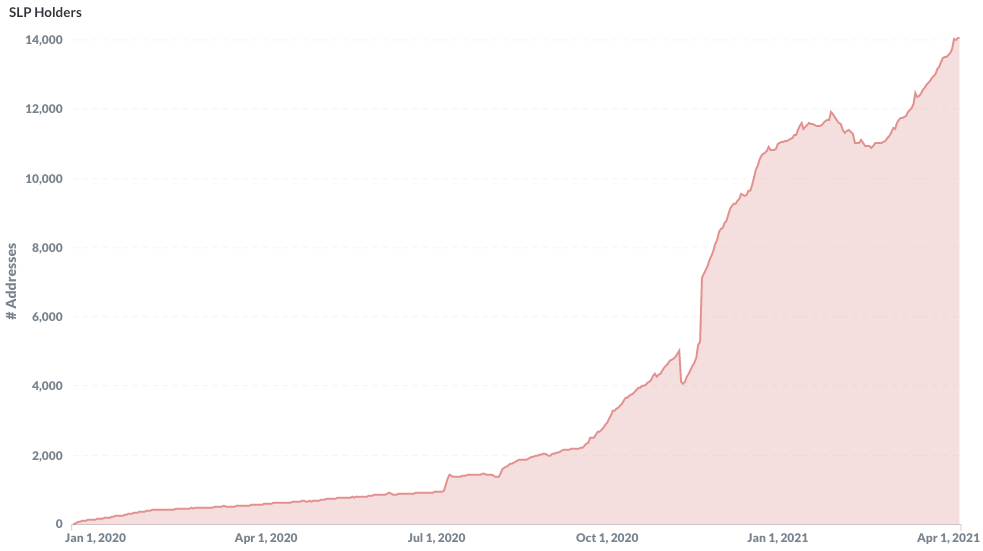

SLP Holders (asset from Axie Infinity game) over time (Source), showing adoption of the game and players who are earning the in-game assets (many for income)

Productizing NFTs as Financial Assets

But I would say that the thing that attracted us to YGG was not a pure NFT-angle but rather the DeFi angle. I think YGG is at the intersection of gaming and DeFi. There’s an NFT component, but the thing that makes this more of a DeFi play is its tokens and token exchange. And it has to do with the interplay between fungible and non-fungible tokens. So they are financializing NFTs.

The Axie creatures themselves are non-fungible, but they are used to play for SLP, a fungible ERC-20 token that can get exchanged into things like Ethereum, USDC, and everything else on UniSwap or other decentralised exchanges (DEX). This becomes more of a DeFi play than like a gaming play or an NFT play. It’s a hybrid.

Other gumi Game and NFT Projects?

gCC has several investments in gaming and NFT space. We were an early investor in OpenSea.io, a marketplace for buying, selling, and trading NFTs.

In NFT marketplaces, we have several other game investments in our portfolio, ThetaToken, which is the streaming service behind Sliver.tv. We also have RobotCache, which is a game platform, and Bling Financial.

What makes YGG different from other projects that you’ve invested in so far?

YGG has done an astonishing thing of managing a variety of in-game assets, which have gone up in value. It’s a very interesting kind of leveraged deal. Not only have those assets gone up in value, but the assets themselves have the potential to generate yield.

I like to think about it, like a Grab or an Uber taxi. There’s the element of depreciation in the game assets that you need to keep investing in the game ecosystem, brand franchise, and community to retain increasing value over time.

Some YGG members even were previously driving things like Grab taxi, and then during the COVID-19 lockdowns, they started driving Axies instead.

In some cases, the Axies they’re driving may belong to Delphi Digital or other crypto whales that own and lend out the assets. This could come under the banner of what’s known as a “Scholarship Program” by YGG.

One of the things that I think is extremely salient about the YGG play is what attention economics. When you look at what happened in the history of DeFi, in its early stages of advancing basic protocols like lending, where Yield Protocol emerged, DEX is a liquidity provision and a source of yield.

But the fascinating thing becomes: how does the liquidity provider participate in this attention economy. How does the liquidity provider enter into these broader financial relationships?

What’s so interesting about YGG’s configuration is its liquidity provision in the form of an NFT. It’s liquidity providing a function.

For us, from a thesis perspective, we’re very excited.

How do you see YGG making an impact on the metaverse?

The play-to-earn business model is part of an emergent digital economy, a beautiful thing to see from an ecosystem perspective. But one of the things that I think is remarkable about YGG is that it’s impacting real people’s lives. This accelerates the potential of the metaverse and the opportunities to provide more opportunity for participation and improved quality of life.

The reason why the players are playing in the guild is that the guild is protecting them. It’s incentivising them. It’s offering them assets that they couldn’t ordinarily get access to make even more money.

For us, when we think about traction, traction isn’t a thing unto itself. But traction is evidence for a product-market fit. We have to ask ourselves, how much evidence is there? It always comes back to the more profound question: Why are the people exhibiting this behavior?

The answer is really compelling.

If people want to find productive things to do with their time, they want to feed their families. They want employment, they want engagement, they want to learn, and they want to develop new skills. They want to have meaning, have a job, or have some good things to do with their lives. If you’re a gamer, then it becomes perfectly meaningful. This is the way to participate in the creation of a metaverse. It’s the feeling that you’re part of this exciting movement that’s so much larger than yourself.

When we talk about the addressable market, YGG is talking about introducing millions of people through this mechanism to the blockchain, which is really astonishing.

My venture fund has Limited Partners, we have investors, and gCC is not a charitable organization. It’s not philanthropy. It’s a very aggressive, and so far, remarkably successful financial venture.

But we do love this idea that we can grow the whole space, we can serve a lot of families, and we can put a lot of food on the table for a lot of people who may be having less economic status.

And at the same time, we can have a very successful DeFi community token experience and a very grateful source of returns for our investors and our fund.

I think it’s this amazing triple-whammy, which is incredibly good for blockchain to add millions of users. It’s good for the people. It’s non-exploitative. So, in a typical game, and the usual plays in attention arbitrage, the people whose attention is less valued are not the beneficiaries of any associated financial returns. These people are most likely coming from emerging markets.

But in this case, because of the formation of this guild structure, that old model is being subverted. And I think that’s exciting. So we’re doing good for the people, doing good for blockchain, and it’s doing good for our venture funds. It’s a tremendous win for everyone.

The Future of Game NFT

Obviously gumi is bullish on the future of game NFT. We feel that NFT will subsume the value of all Intellectual Property by building internet infrastructure that enables programmatic compensation and financialization of all intellectual property assets in the world.

We are at a unique time in this process; we are recapitulating human history and NFTs are undergoing a “renaissance” right now. The biggest thing to happen in the Renaissance were art patronage and the expansion of skilled craft guilds such as physicians, apothecaries and spice merchants. Since blockchain based assets have created wealthy sovereigns, the step of patronage is logical. The evolution of skilled craft guilds is logically next.

Obviously the Metaverse economy is coming, and as with all economies the balance between capital and labor produces natural tension. Seeing a win win win between NFT holders like Delphi Digital, game designers like Axie and Sandbox and guilds like YGG starts to model the steady state metaverse economy.

Disclaimer

Information is provided for general educational purposes only. This presentation is not an offer to sell securities or a solicitation of offers to buy securities. Nothing contained herein constitutes investment or other advice nor is it to be relied on in making an investment decision. For more important information, please see disclaimer